Medical expenses, both planned and unexpected, can take a toll on a family’s finances. Even with health insurance, the cost of insurance premiums and out-of-pocket expenses can weigh heavily on your pocketbook.

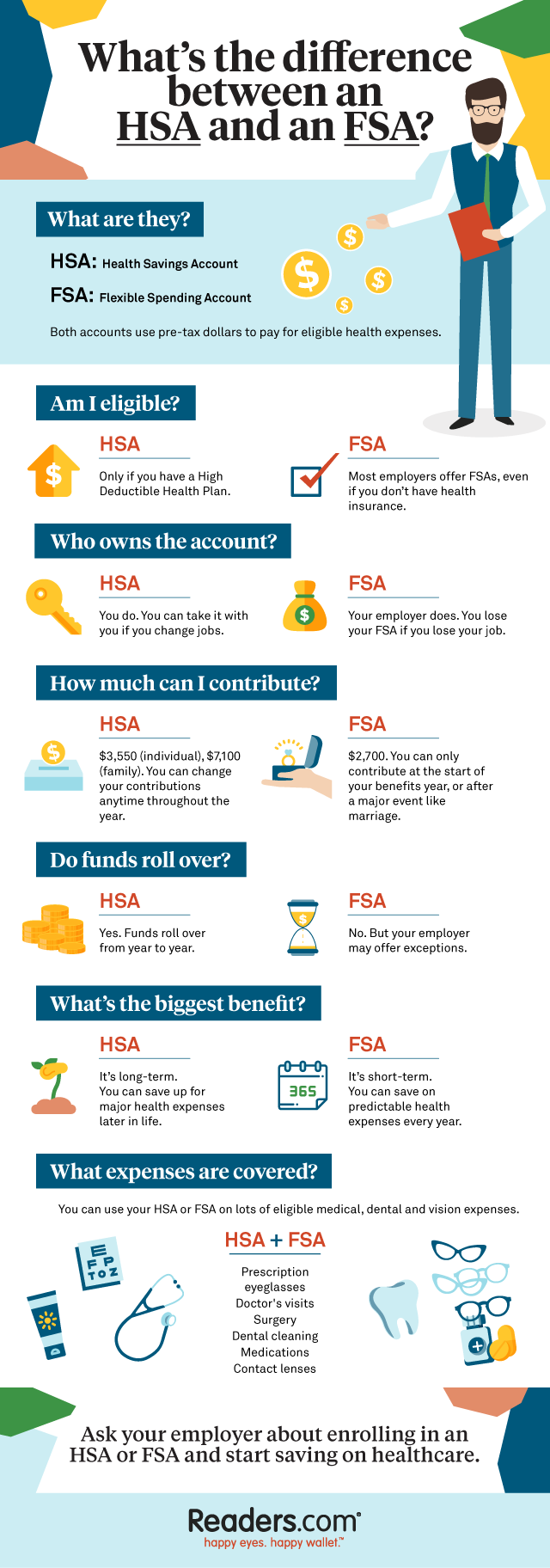

One way to prepare for rising medical costs? Open a Health Savings Account (HSA) or a Flexible Spending Account (FSA) where a portion of your paycheck can be automatically deposited into this account. According to Wageworks.com, which provides health savings and consumer-directed benefits for employers and employees, these plans may allow the average participant to save about 30% on all annual health expenses.

Interested? We’ve broken down the difference between FSA and HSA account types, who is eligible, and what costs are covered by these types of accounts.

↓ Click to enlarge infographic ↓

Health Savings Account (HSA)

A Health Savings Account (HSA) is just what it sounds like: a savings account that can be used to pay for eligible medical expenses. If you have a qualified High Deductible Health Plan (HDHP) and meet other qualifications, you may be eligible for an HSA.

By depositing money into an HSA account, you can save money designated for qualified medical expenses. To make it even easier, you can have money from your paycheck set up for direct deposit.

The purpose of an HSA is to help you plan ahead, budget, and save for any unexpected or planned medical expenses. Although you may be unsure if it is worth it to put money towards your HSA, it’s important to note that HSA funds roll over from year to year and have the potential to be used as a retirement savings tool. For 2020, the IRS has set the maximum HSA contribution for a family is $7,100 and $3,550 for individuals. HSA participants have the flexibility to adjust the deduction amount at any time by notifying their provider. Anyone 55 or older can contribute an additional $1,000 to their account.

Any funds contributed to your HSA account are tax-free, and any eligible withdrawals from the account to pay for approved medical expenses are tax-free, too. If you switch jobs, your HSA account stays with you, so you can continue to use it for as long as you’d like.

You will want to be sure to check with your healthcare provider or plan manager to learn all of the qualifications, terms, and limits for HSA accounts.

Flexible Spending Account (FSA)

A Flexible Spending Account or Flexible Spending Arrangement (FSA) is a more common health savings option offered by most employers. You do not have to have health insurance to enroll in an FSA.

Similar to the HSA, you can have money from your paycheck directly deposited into an FSA account. All contributions for an FSA must be determined and declared at the start of the plan’s calendar year. Changes to the determined amount cannot be changed unless a qualifying event occurs, including a marital status change or the birth of a child. The IRS set a maximum contribution limit of $2,750 for individuals in 2020.

Any money deposited into this type of account is tax-free. While HSAs can be used as a savings account, FSA funds do not roll over, so all funds must be used before the end of your benefit or calendar year. Some employers may offer exceptions or grace periods for rollovers. However, if you change employers your FSA does not follow you, and you will leave behind any unused FSA money in your account.

You will want to be sure to check with your healthcare provider or plan manager to learn the qualifications, terms, and limits for FSA accounts.

Eligible Medical Expenses

You might be asking yourself “are reading glasses FSA eligible?” Yes! Over the counter reading glasses are covered under most FSA and HSA plans. The following are general categories that are deemed as an FSA-eligible medical expense, but we encourage you to check with your specific plan provider before using your HSA or FSA account funds.

Common FSA-eligible medical expenses include:

- Eyeglasses and contacts

- Over the counter reading glasses

- Prescription drugs

- Copayments

- Deductibles

- Medical equipment

- Chiropractic care

- Dental costs

How Do I Use HSA or FSA Funds to Buy Reading Glasses?

You should receive checks or a debit card when you set up an HSA or FSA account, allowing you to make withdrawals from your account. When checking out on Readers.com®, simply enter the card information just as you would for any other debit or credit card. Be sure to keep your receipt in case you should be audited. If you have any questions, contact the Readers.com® team at 1-800-210-3975.

You should receive checks or a debit card when you set up an HSA or FSA account, allowing you to make withdrawals from your account. When checking out on Readers.com®, simply enter the card information just as you would for any other debit or credit card. Be sure to keep your receipt in case you should be audited. If you have any questions, contact the Readers.com® team at 1-800-210-3975.

You can read more about HSA and FSA plans from the IRS, and check to see if reading glasses are covered by your specific account here.

0 Comments